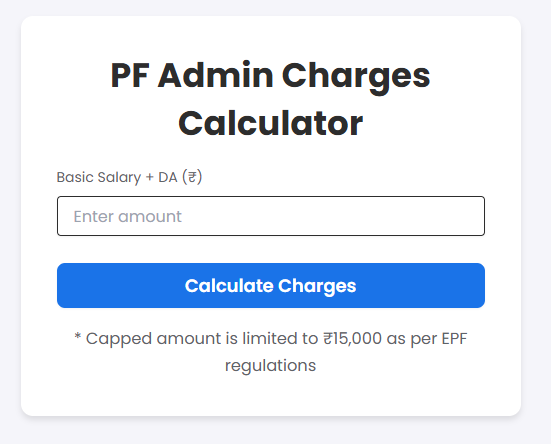

PF Admin Charges Calculator

PF Admin Charges Calculator – 2025 | Auto Calculate EPF Admin Fee & Employer Contribution

Are you confused about how to calculate EPF Admin Charges and employer contributions? Don’t worry! Our free PF Admin Charges Calculator – 2025 makes it easy and quick to compute accurate charges based on the latest EPFO rules.

Designed especially for HR managers, accountants, startups, and payroll teams, this tool calculates the employer’s EPF contribution, admin charges, and capped amount, all in a single click.

What This Tool Does

This calculator is based on EPFO regulations (2025) and takes into account:

Employer’s EPF Contribution (3.67%)

Wage Cap of ₹15,000

Admin Charges (0.50%)

For instance, if your entered Basic Salary + DA is ₹30,000, the tool will:

Cap the calculation to ₹15,000 (as per rules)

Calculate 3.67% of ₹15,000 = ₹1,101 as EPF Contribution

Calculate 0.5% Admin Charges = ₹75

Note: EPF wages are capped at ₹15,000/month, even if salary is higher.

How to Use the PF Admin Charges Calculator

Here’s how to use this tool effectively:

Enter your Basic Salary + Dearness Allowance (DA)

For example: ₹30,000Click on the “Calculate Charges” button

Instantly, you’ll get:

Employer’s EPF Contribution (3.67%)

Capped Amount (₹15,000)

Admin Charges (0.5%)

No login, no registration—get results in 1 second!

Tools Overview

EPF Admin Charges Structure in 2025

| Component | Rate | Minimum |

|---|---|---|

| PF Admin Charges | 0.50% | ₹500/month |

| EDLI Admin Charges | 0.50% | ₹200/month |

| Total Admin Outflow | 1.00% | ₹700/month |

Note: Employers must bear these costs in addition to their 12% EPF contribution.

Why Use a PF Admin Charges Calculator?

Using this tool saves time, reduces errors, and helps meet regulatory requirements. It’s perfect for:

Using this tool saves time, reduces errors, and helps meet regulatory requirements. It’s perfect for:

HR & Payroll Professionals

Chartered Accountants

Finance Teams

Small Business Owners

Instead of manual calculations or Excel templates, this calculator gives instant, accurate, and auto-updated results.

Key Features

Based on EPF Act 1952

Auto caps at ₹15,000 salary

Supports admin charge rate of 0.5%

Easy to use on desktop & mobile

Free for unlimited use

Who Can Use This Tool?

Startups looking to automate PF calculations

MSMEs managing payroll manually

CAs & Auditors reviewing employer PF compliance

Students or researchers studying Indian labour law

Example Output

Let’s say your input is ₹30,000, the result will be:

| Calculation Type | Value |

|---|---|

| Capped Salary (as per EPF) | ₹15,000 |

| Employer’s EPF Contribution | ₹1,101 (3.67%) |

| Admin Charges (0.5%) | ₹75 |

For detailed official guidelines on PF Admin Charges and EPF contributions, you can refer to the

EPFO Contribution Table (Govt. PDF)

Quick Links:

Frequently Asked Questions (FAQs)

The PF Admin Charges Calculator is an online tool designed to help employers calculate the administrative charges they need to pay to the Employees’ Provident Fund Organization (EPFO) in addition to the regular PF contributions. It gives clarity on the total employer cost involved in employee EPF compliance.

You simply enter the employee's basic salary or PF wages, and the calculator automatically applies the standard administrative charge rate (currently 0.50%) to show you the exact monthly PF admin amount payable per employee.

The PF administrative charges are completely paid by the employer. These are over and above the employer's 12% EPF contribution and are not deducted from the employee’s salary.

As per EPFO norms in 2025, the PF admin charge rate is 0.50% of basic wages, subject to a minimum of ₹500 per month per establishment. For establishments with no contributory member, the minimum admin charge is ₹75 per month.

No, this specific tool is designed to calculate only the PF administrative charges. For a complete breakdown including EPF, EPS, and EDLI, you can use a full PF Contribution Calculator separately.

No, the tool is completely free, requires no login, and is accessible online through any device—whether mobile, tablet, or desktop.